Driving impact 2026 Unlocking the opportunity for corporate social impact investment in the United Kingdom

By Macquarie Group Foundation

18 Feb 2026

This report explores how companies can use social impact investment to support charities and social enterprises while creating lasting social value. It explains what corporate social impact investment is, why uptake remains low in the UK, and what organisations can do to overcome barriers and unlock impact-first funding models.

View resourceSummary

This report examines how corporations, particularly in the UK’s financial and professional services sector, can use social impact investment to address complex social challenges. It was commissioned by the Macquarie Group Foundation and draws on research, interviews, and real examples from across the sector. The report focuses on impact-first investment, where social outcomes are prioritised over financial returns.

Corporate social impact investment sits between traditional philanthropy and commercial investment. It often uses concessionary or catalytic capital, meaning companies accept lower returns, higher risk, or more flexible terms to enable social benefit. This type of capital can help charities, social enterprises, and mission-driven businesses grow, test new ideas and attract further funding.

The report finds that while interest in social impact investment is growing, actual participation by corporates remains low. Internal barriers include limited understanding of impact investing, lack of senior leadership buy-in, skill gaps, confusing language and siloed teams. Many organisations struggle to align philanthropy, business functions and governance structures in a way that supports impact-first investing.

Systemic barriers also slow progress. These include uncertainty about legal and regulatory rules, limited availability of catalytic capital, challenges with co-investment due to competition and confidentiality concerns and a lack of shared systems for deploying pro bono expertise. The report highlights that these issues cannot be solved by individual organisations alone and require collective action across the ecosystem.

Using case studies, the report shows how some corporates are already contributing through loans, equity investments, blended finance, first-loss grants, and structured pro bono support. These approaches not only support social purpose organisations but also help companies engage employees, build skills, strengthen reputation and develop new relationships.

The report concludes with practical recommendations. These include building internal knowledge through training and learning by doing, securing leadership support, simplifying language, strengthening governance, collaborating with intermediaries, and investing in shared learning and peer networks. Overall, the report argues that corporate social impact investment has significant potential to strengthen the social sector if organisations work together, take a long-term view and commit to impact-first approaches.

We’d love to hear from you!

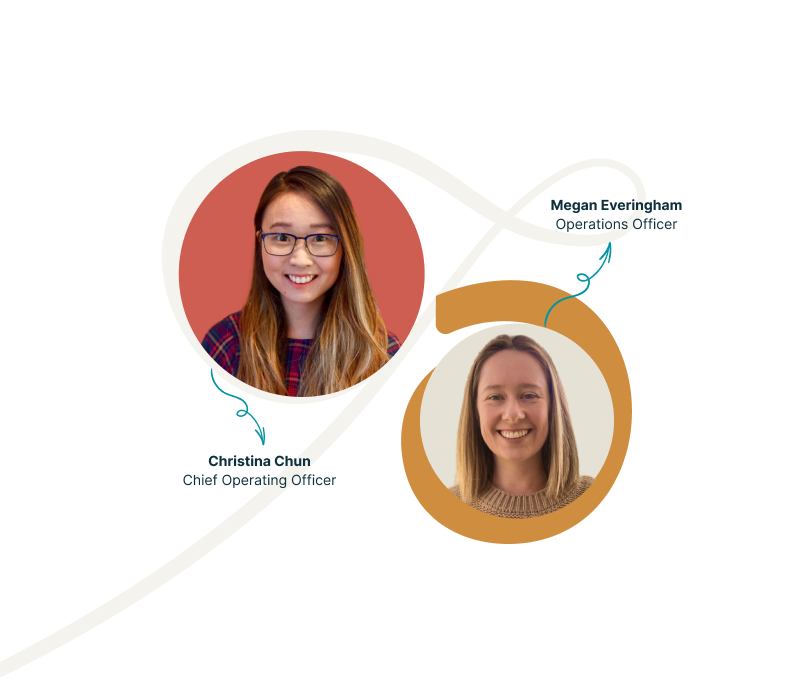

Reach out to one of our team members, and share input and ideas about how we can evolve Understorey.

Get in touch