.png)

Platforms

Australian Tax Office (ATO)

The ATO offers essential tax and super info for businesses, including social enterprises, covering worker status, payments, and related obligations.

View resourceSummary

The ATO provides tax and super information to businesses and organisations, including social enterprises.

Understanding and complying with tax and super obligations is critical for all social enterprises.

The ATO site includes detailed information about engaging and paying workers, including considerations about whether a worker is an employee or an independent contractor noting that this affects tax, super, and other obligations.

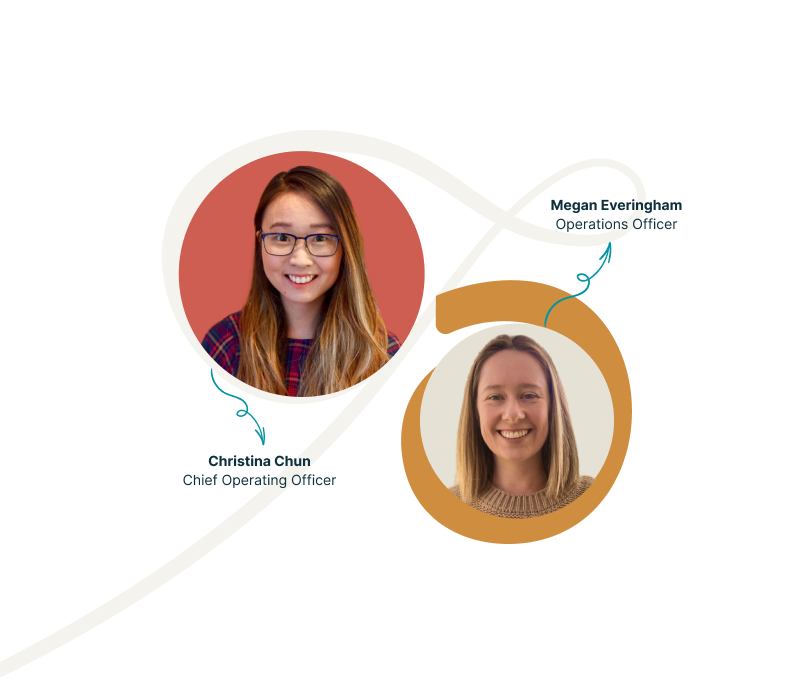

We’d love to hear from you!

Reach out to one of our team members, and share input and ideas about how we can evolve Understorey.

Get in touch