Deductible Gift Recipient (DGR)

An organisation or fund that can receive tax-deductible gifts. DGR endorsement is a concession under the Income Tax Assessment Act 1997 (Cth) and is administered by the Australian Taxation Office (ATO).

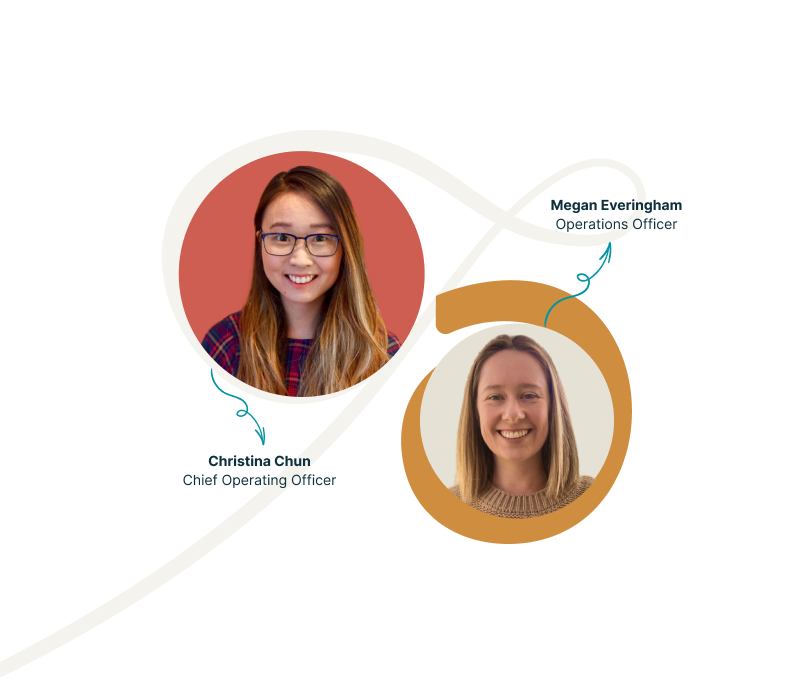

We’d love to hear from you!

Reach out to one of our team members, and share input and ideas about how we can evolve Understorey.

Get in touch